indiana real estate tax lookup

If you meet those requirements youll need to take 90 hours of pre-licensing education. Real Estate ABC - Information on Buying and Selling A Home Interest Rate Report - Jul 2015.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Pass the Colorado Real Estate Broker License exam.

. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax. Indianas sales tax rates for commonly exempted items are as follows. The exam has state and national sections.

Some necessary information needed for the search is the county where the real estate is and an address or the owners full name. Tax Collection Dates. The degree quantity nature and extent of interest that a person has in real and Personal Property.

In order to be eligible for real estate licensure in the state of Indiana you must be 18 years or older and obtain a high school diploma or the equivalent. Next youll take and pass the Colorado Real Estate Broker Licensing Exam which is administered by PSI. Also being handled by the Superior Court of the State of Arizona will be cases centering around equity real estate or complex cases involving concurrent jurisdiction where exclusivity has been established.

Missouri Real Estate Agent License. Read on to learn about the eight steps youll need to complete before starting your career in Louisiana real estate. 2020 payable 2021 tax statements will be mailed April 12 2021.

The owner of record is determined by who owned the property as of January 1st of the previous year. To learn about how much it costs to get your real estate license visit our Louisiana Pre-Licensing pricing page. Indiana Real Estate License.

Getting your Louisiana real estate license might seem daunting but were here to guide you through the process. To lookup the sales tax due on any purchase use our Indiana sales tax calculator. This exam consists of an 80-question National portion with a 120-minute time allowance and a 74-question State portion with a 110-minute time allowance.

The classes will prepare you for the New Mexico real estate exam. Begin the process by completing 48 hours of pre-licensing education. The judges for the Superior Court of the State of Arizona are voted in elections with all similar county positions and serve a 4-year term.

You also have to take the 24-hour Missouri Real Estate Practice Course. You have to be at least 18 years of age and have a high school diploma or GED to sell real estate in New Mexico. When used in connection with probate proceedings the term encompasses the total property that is owned by a.

New Mexico Real Estate Agent License. Such terms as estate in land tenement and hereditaments may also be used to describe an individuals interest in property. Long-term mortgage interest rates continued their move to record highs for 2015 according to data from mortgage finance company Freddie Mac.

Free Colorado Property Owner Search In the 21st-century the internet has made things more accessible than ever for anybody trying to obtain the information they may need when it comes to Colorado residential or. You need a salesperson license to sell real estate in Missouri. You must then take the Missouri salesperson exam and pass both sections.

Real Estate and Personal Property taxes are due on May 10 2021 and November 10 2021. The first step in obtaining your license is to complete 75 hours of state-approved pre-licensing education and pass the final exam of your course with a 75 or. Boats and real estate sales may also vary by jurisdiction.

Treasurer Johnson County Indiana

Treasurer S Office Tipton County In

The Ultimate Guide To Indiana Real Estate Taxes

Pennsylvania Property Tax H R Block

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Property Tax Calculator Smartasset

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Riverside County Ca Property Tax Calculator Smartasset

2022 Property Taxes By State Report Propertyshark

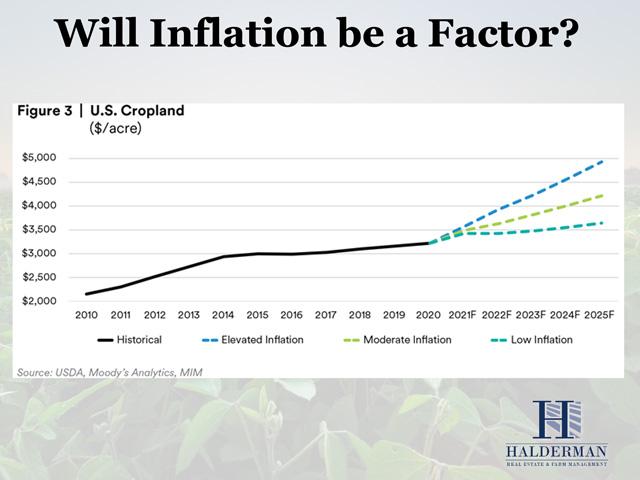

Will Farmland Prices Keep Rising After Setting Records In March

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Property Records Information Hamilton County In

Deducting Property Taxes H R Block

Where People Pay Lowest Highest Property Taxes Lendingtree

Treasurer Johnson County Indiana