unemployment tax break refund tracker

If you chose to receive your refund through direct deposit you should receive it within a week. Its best to track your refund using the wheres my refund tool mentioned above.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits.

. The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. WHILE there are 436000 returns are still. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT All unemployment claims run from Sunday to Saturday You may not file for unemployment before your actual layoff date If you file early it will code your claim for the prior week and could result in a flag being placed on your claim. When to expect a refund for your 10200 unemployment tax break. The IRS is starting to send money to people who fall in this categorywith more refunds slated to arrive this summer.

How to speak directly to an IRS agent. See reviews photos directions phone numbers and more for New Jersey Tax Refund locations in Piscataway NJ. If youre married and filing jointly you can exclude up to 20400.

Press 3 for all other questions. By Anuradha Garg. The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective.

Everything is included Premium features IRS e-file 1099-G and more. Online portal allows you to track your IRS refund. The IRS began to send out the additional refund checks for tax withheld from unemployment in May.

If you see a Refund issued then youll likely see a. In addition this department collects annual sewer fees. While you would need to amend your tax return under normal circumstances the IRS introduced a law that.

The first10200 in benefit income is free of federal income tax per legislation passed in March. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. Press 1 for questions about a form already filed or a payment.

Press 2 for questions about your personal income taxes. The irs just sent more unemployment tax refund checks with the latest batch uncle sam has now sent tax refunds to over 11 million americans for the 10200 unemployment compensation tax exemption. Heres how to check online.

You can check on the status of your refund by clicking on the links below. July 20 2021 939 AM. The Internal Revenue Service and the Department of Treasury started sending out unemployment refunds to taxpayers who didnt claim their rightful unemployment compensation on their federal income tax returns.

Check For The Latest Updates And Resources Throughout The Tax Season. The refunds are being sent out in batchesstarting with the. He IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective.

If you havent opened an account with the IRS this will take some time as youll have to take multiple steps to confirm your identity. Choose the federal tax option and the 2020 Account Transcript. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Lets track your tax refund. The IRS began to send out the additional refund checks for tax withheld from unemployment in May.

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. There is no tool to track it but you can check your tax transcript with your online account through the IRS. If you use e-file your refund should be issued between two and three weeks.

The only way to see if the IRS processed your refund online is by viewing your tax transcript. Select your language pressing 1 for English or 2 for Spanish. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break.

22 2022 Published 742 am. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

The letters go out within 30 days of a correction. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. Visit IRSgov and log in to your account.

How to claim an unemployment tax refund and how to check the IRS payment status The American Rescue Plan provided a significant tax break for those who received unemployment. The 10200 is the amount of income exclusion for single filers not the amount of the refund. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income.

Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. Ad See How Long It Could Take Your 2021 Tax Refund.

The IRS should issue your refund check within six to eight weeks of filing a paper return. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. Tax Break Tracker is a database on governmental tax abatement disclosures.

22 2022 Published 742 am. You were going to receive a 1500 federal tax refund. Basically you multiply the 10200 by 2 and then apply the rate.

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. Refund for unemployment tax break. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for.

WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. Call the IRS at 1-800-829-1040 during their support hours. Thats the same data.

Your Tax Questions Answered Marketplace

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Still Waiting For Your 10 200 Unemployment Tax Refund How To Check Status Dailynationtoday

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

4 Steps From E File To Your Tax Refund The Turbotax Blog

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

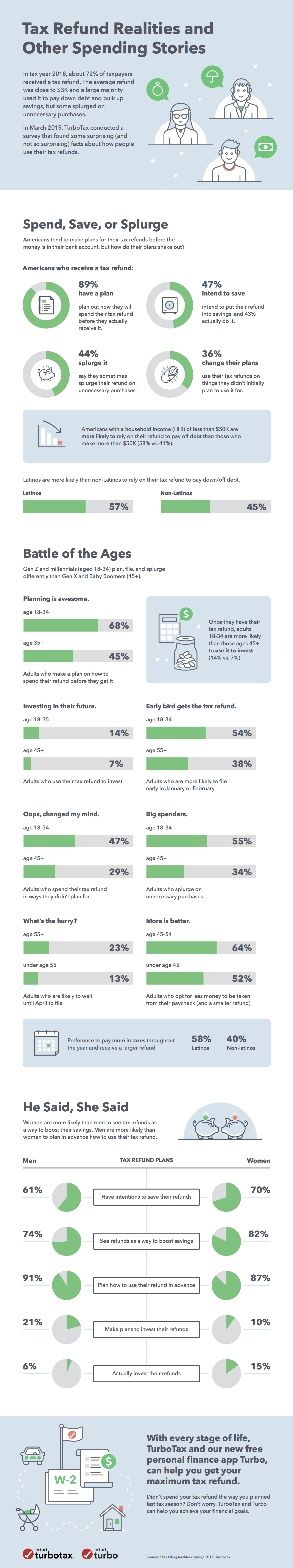

Tax Refund Realities And How Americans Spend And Save Their Tax Refunds Infographic The Turbotax Blog

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irsnews On Twitter Use The Where S My Refund Tool To Start Checking The Status Of Your Refund 24 Hrs After Irs Acknowledges Receipt Of Your E Filed Tax Return You Can Access The

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Tax Refund Timeline Here S When To Expect Yours

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of