extended child tax credit 2021

Along with a 1400 stimulus check and extended unemployment benefits the 19 trillion COVID relief package signed into law on Thursday expands the Child Tax Credit. The new bill known as the American Rescue Plan includes the following changes to this tax credit for tax year 2021.

Payments From The Expanded Child Tax Credit Are Being Sent Out Npr

Here is some important information to understand about this years Child Tax Credit.

. Filing With TurboTax Is Fast And Easy. In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child tax credit CTC. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child.

Get Your Tax Returns Done. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. Originally it offered taxpayers a tax credit of up to 2000 for each qualifying dependent.

If you received advance Child Tax Credit payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. If youre eligible you could receive part of the credit in 2021 through advance payments of up to. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account.

In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and 3000 for kids 6 to 17. 3600 for children ages 5 and under at the end of 2021. And 3000 for children ages 6 through 17 at the end of 2021.

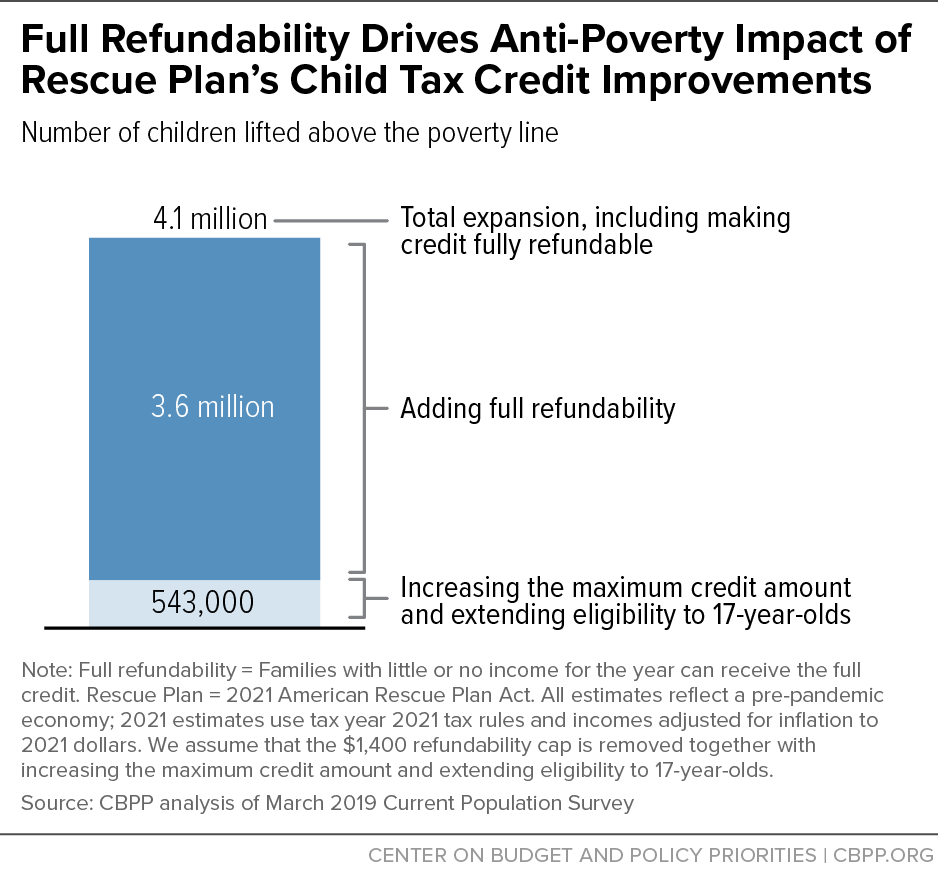

1600 per child ages 5 and below Total tax credit 3600 1000 per child ages 6-17 Total tax credit 3000 The age of the child is determined at the end of 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Expanded Child Tax Credit for 2021 The American Rescue Plan increased the amount of the Child Tax Credit CTC made it available for 17-year-old dependents made it fully refundable for most families and made it possible for families to receive up to half of it in advance in monthly payments during the last half of 2021.

The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. What Is the Expanded Child Tax Credit.

Prior to this years expansion families received a credit of up to 2000 per child under age 17. The expansion imposed as part of the. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6.

The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting 37 million children out of poverty as of. However the 2021 American Rescue Plan expanded this credit in. Qualifying parents wouldnt have.

Advance Child Tax Credit Payments in 2021. As part of the American Rescue Plan last year the Biden administration authorized a significant expansion of the child tax credit for 2021. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. June 14 2021. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

2021 Child Tax Credit and Advance Payments. Ad Get Your Maximum Refund Guaranteed When You File With Americas 1 Tax Software. The legislation made the existing 2000 credit per child more generous.

For tax year 2021 the Code section 24 Child Tax Credit before considering any phaseout is the 2000 credit plus an additional. It increases the credit amount. The Child Tax Credit provides money to support American families.

Democrats are reportedly drafting legislation to expand the child tax credit from 2000 to 3000 or 3600 depending on the childs age and the familys income. E-File Directly to the IRS. This tax credit is changed.

We dont make judgments or prescribe specific policies. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Under the new law the maximum value of the credit rose to 3600 from 2000 per child depending on their age and family income level.

The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting 37 million children out of poverty as of December 2021. While not everyone took advantage of the payments which started in July 2021 and ended in December last year eligible parents were rewarded with up to 300 per month. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to eligible taxpayers.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. It provided families with up to 3600 for every child in the household under the age of six and up to 3000 for every child between the ages of 6 and 17.

January 28th 2021 1305 EST. Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for qualifying families. See what makes us different.

The ARPAs expansion of the child tax credit resulted in a one-year fully refundable credit of up to 3000 per child age 6 and up and 3600 for children under age 6 to be paid in periodic. It increases the credit amount from 2000 to 3000 for children 6- 17. Learn More At AARP.

The American Rescue Plan Act expands the child tax credit for tax year 2021. Home of the Free Federal Tax Return. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Parents Guide To The Child Tax Credit Nextadvisor With Time

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Expanded Child Tax Credit Senator Bernie Sanders

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Will The New Child Tax Credit Be Extended Forbes Advisor

Child Tax Credit 2022 Are You Eligible For Money From Your State Cnet

Taxes 2022 What Families Should Know About The Child Tax Credit Youtube

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Here S Who Qualifies For The New 3 000 Child Tax Credit

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities